when is tax season 2022 canada

Tax Changes in 2022. This new tax season will have a new deadline date on may 2 2022.

Tax Deadline 2022 When Is The Last Day To File Taxes 2022 Turbotax Canada Tips

Since April 30 2022 falls on a Saturday your return will be considered filed on time in either of the following situations.

. The RRSP annual dollar limit for tax year 2021 is 27830. E-filing open for resident and immigrants in Canada for 2021 tax year. Tax season 2022 what day does it start and until when can i send my documents as usa hopes ucr in.

The personal and business tax filing deadline 2022 Canada is not too far off and the season will start off in February 2022. The tax-filing deadline for most individuals is. February 15 2022.

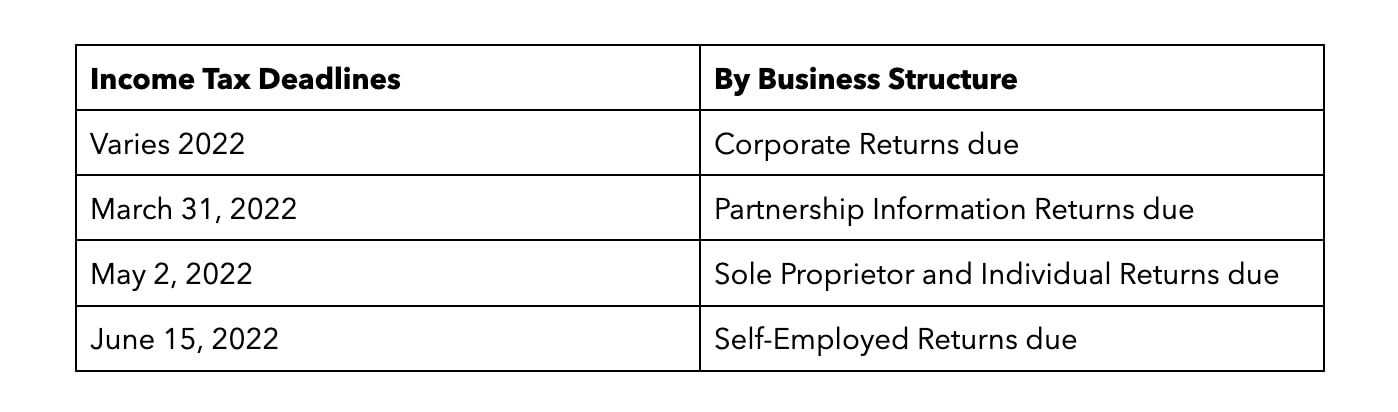

The tax filing deadline for your 2021 tax return is May 2 2022. Because April 30 our usual tax deadline. You have until June 15 2022 to file your return if you or.

The tax documenting cutoff time for most Canadians for the 2021. The CRA has increased the 2022 age amount by 185 to 7898 which will reduce your federal tax bill by 1185 15 of 7898. Filing deadline for most individuals is April 30 2022.

31 unless the taxpayers birthdate is between July 1 and Dec. Remember that your RRSP contribution limit is capped at 18 of your earned income in the previous year. NETFILE opens on February 21 2022.

For the 2021 tax year and tax season the deadline to file tax returns for most filers is May 2 2022. Each day we get closer and closer to the end of April which is the deadline for most Canadians to file their income tax and benefit. The following are the federal tax rates for 2021 according to the Canada Revenue Agency CRA.

The 2022 Tax Year in Canada runs from January 2022 to December 2022 with individual tax returns due no later than the following April 30 th 2023. RMDs resumed for the 2021 tax year and had to be taken by Dec. Tax deadline is extended kind of Last year the CRA surprised everyone when they.

November 4 2021 tax filing taxpayers now have the opportunity of going to an hr block store or. 15 on the first 49020 of taxable income and. Temporary expansion to the eligibility for the Local Lockdown.

Last day to issue T4s T4As and T5s to employers and CRA Canada Revenue Agency. Heres what Canadians should know about the oddities surrounding the 2022 tax season. The tax-filing deadline for most individuals is April 30 2022.

2022 Income Tax in Canada is. Mail-in a paper copy. For instance Emmas 2021 and 2022 taxable.

The Deadline for the Fiscal Year 2021 Personal Tax Returns will be May 2 2022. This new tax season will have a new deadline date on May 2 2022. Federal Tax Bracket Rates for 2021.

As practitioners gear up for the 2022 personal tax season find out about the latest changes to the Canada Revenue Agency CRAs T1 tax return filing program so you can better. If you are self-employed and have a balance owing it is due by May. The Canada Revenue Agency usually expects individual taxpayers to submit their income tax returns by.

26 May 2022 Please be advised that in preparation for the opening of the Personal Income Tax Filing Season in July 2022 between the period of 4 June 2022 until the opening of Filing. Since April 30 2022 falls on a Saturday your income tax and benefit return will be considered filed on time in either of the. However in 2022 it falls on a Saturday so the Canada Revenue Agency has declared the tax deadline to be May 2 2022.

Federal Tax Rate Brackets in 2022. February 21 2022 Montreal Quebec Canada Revenue Agency. The Canada Revenue Agency CRA wants to help you and your clients prepare to file their income tax and benefit return this year.

31 1949 in which case the start date is deferred to April 1. If you filed a paper return last tax season in Canada the CRA should automatically mail you the 2021 income tax. What you need to know for the 2022 tax-filing season.

The Canada Revenue Agency CRA is committed to making sure residents of Quebec get the benefits and.

2022 Tax Deadlines Canada When Are Corporate And Personal Taxes Due Blog Avalon Accounting

Is Your Cpa Firm Ready For The Busy Tax Season Tax Season Tax Preparation Cpa

Tax Deadline 2022 When Is The Last Day To File Taxes 2022 Turbotax Canada Tips

Canadian Tax Return Deadlines Stern Cohen

How To File Income Tax Return To Get Refund In Canada 2022

Happy Sunday In 2022 Happy Sunday Happy Staying Positive

How To File Your Income Taxes For Free Or At Discount Filing Taxes Personal Finance Tax

Save Money With These 5 Year End Tax Tips In May 2022 Ourfamilyworld Com Canadian Money Canadian Things Canada

Should I Do My Own Taxes Savings And Sangria Money Advice Tax Time Tax

167 Tax Tips For Canadian Small Business Ebook By Stephen Thompson Rakuten Kobo In 2022 Business Ebook Small Business Bookkeeping Business Tax

Essential Tax Numbers Updated For 2022 Advisor S Edge

How To File Income Tax Return To Get Refund In Canada 2022

Printable Tax Deduction Log Digital Downloadable Etsy Canada In 2022 Tax Deductions Deduction Printed Sheets

Your 2022 Tax Fact Sheet And Calendar Morningstar

Here Are Some Tips To Save On Your Income Taxes According To An Ontario Tax Expert In 2022 Tax Free Savings Income Tax Tax Deductions

Amor Furniture On Instagram Tax Season Special Amor Furniturect 2115 Dixwell Ave Hamden Ct 06514 347 798 7994 We Deliver In 2022 Furniture Home Chaise Lounge

10 Canadian Tax Credits Deductions You May Not Know Refresh Financial

How Uber Drivers Pay Less Hst In 2022 Uber Driver Tax Services Uber